Simply Leasing Sponsorship News |

Is Leasing a Car a Good Idea for Your Business?

We are delighted to announce that Simply Leasing will be sponsoring our fifth event of the 2022 tour at Manchester Golf Club.

Utilising their extensive sector experience, product knowledge and business relationships, Simply Leasing provides their clients with tailored vehicle funding packages.

They provide a range of bespoke vehicle funding options, including:

- Contract Hire

- Personal Contract Hire

- Contract Purchase

- Personal Contract Purchase

- Lease Purchase

- Finance Lease

Is Leasing a Car a Good Idea for Your Business?

Depending on your business requirements and whether you are a sole trader, partnership, limited or public limited company, leasing cars or vans is the most popular way to drive brand-new vehicles for various work-related purposes.

Read on to see a breakdown of the key things to consider when leasing a car or van to see if it’s the right fit for your business.

What Is Business Car Leasing?

It is common for businesses to sign up to a BCH agreement for their vehicles, be it for one car or van, a few vehicles or a large business fleet – it works out as our most suitable form of leasing for business owners. The contract term is flexible, and is usually anything between one and four years, depending on what the business owner requires.

What are the advantages of leasing a company car?

Cost savings, tax benefits, and the perks of driving a new car or fleet every few years are just a few of the reasons why business car leasing is becoming a popular choice for companies and their employees.

If you’re debating whether to lease a car for your business, read on to learn about the main advantages of doing so.

Lower Costs – Improved Cash Flow

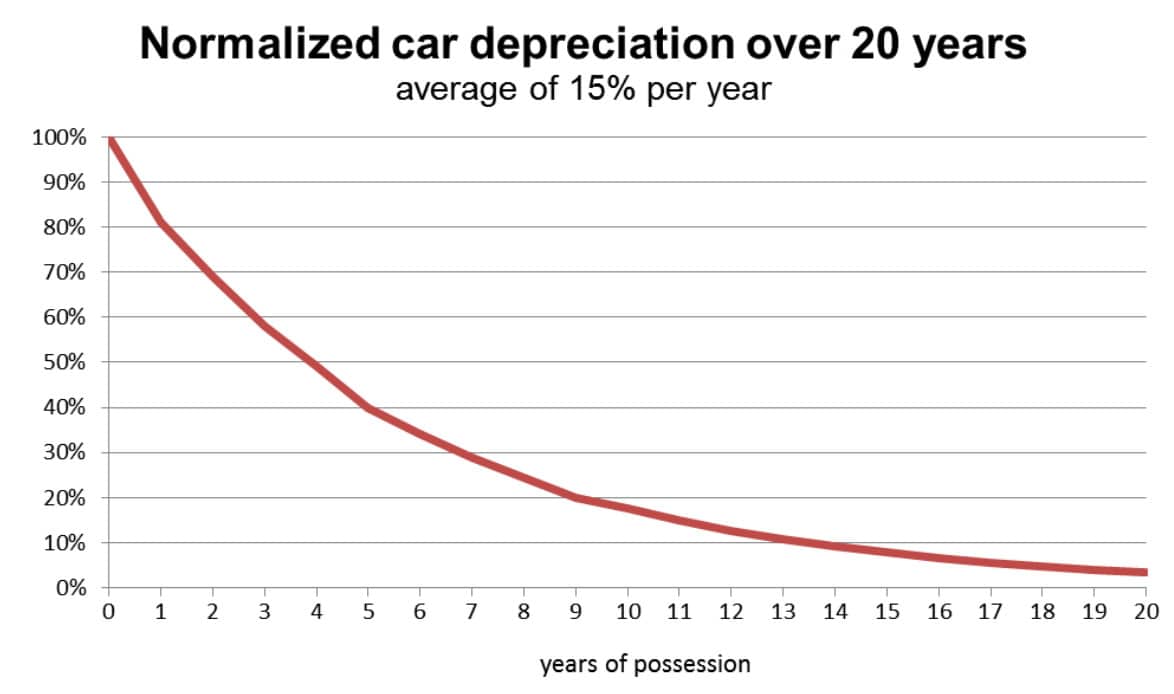

Protection From Depreciation

Reclaim Costs Through Corporation Tax

Usually Cheaper Than Personal Leasing

Take a look at Simply Leasing’s wide range of cars/vans and switch from ‘personal’ to ‘business’ to see how much you could save.